J&K Eliminating TB

News Kashmir Analysis

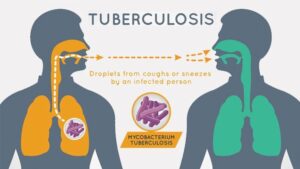

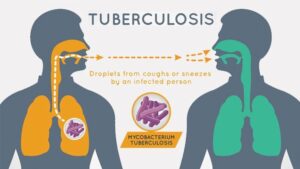

Tuberculosis is one of the dangerous disease that humanity has encountered. It has been a major health challenge in our region and Country as well.

But we are proud to know that India as country has by and large reduced Tuberculosis threat to great extent.

Recently, Secretary H&ME, Dr. Syed Abid Rashid Shah, informed that significant progress has been achieved in strengthening TB surveillance, infrastructure, and early diagnostic systems. He stated that J&K has achieved 100% notification of TB cases, with 11,499 cases reported, while 92% of the vulnerable population has been screened placing the Union Territory among the best-performing regions in the country.

Jammu and Kashmir

Chief Secretary, Atal Dulloo, recently chaired a high-level meeting to review the progress of the TB Mukt Bharat Abhiyan and assess the measures undertaken by the Health & Medical Education Department to achieve the vision of a Tuberculosis-free Jammu and Kashmir.

The meeting was attended by Secretary, Health & Medical Education (H&ME), Dr. Syed Abid Rashid Shah; Mission Director, National Health Mission (NHM), Baseer-Ul-Haq Chaudhary; Managing Director, JKMSCL; Principals of Government Medical Colleges (GMCs); Directors of Health Services, Jammu and Kashmir; HoD, Chest Medicine, GMC Srinagar; and senior faculty members from various medical institutions across the UT. Deputy Commissioners joined the deliberations through video conferencing.

reviewing the current scenario, the Chief Secretary stressed the need for early identification and comprehensive management of TB patients to ensure their complete recovery. He directed health professionals to undertake end-to-end monitoring of patients, encouraging them to personally adopt a few cases each, extend individualized medical support, and maintain regular contact with patients to track their progress.

Underscoring the importance of vigorous contact tracing, Dulloo called for strengthening the network of ASHA workers to facilitate home visits and ensure ‘at-home’ care and counselling, thereby improving adherence to treatment and recovery outcomes.

A year back ,we had learnt that Three districts in Kashmir—Budgam, Anantnag, and Pulwama—have already been declared TB-free, while Srinagar and Kupwara have achieved gold certification under the Sub-National Certification. J&K has also been recognized with a bronze medal for its efforts under the same programme.

TB which once was severe health challenge for the people of country is steadily becoming less threat due to great efforts of Central Government.

Jammu and Kashmir is taking rapid strides in becoming Tuberculosis free.